Bitcoin Market News

by Team

There have been a lot of stories about Bitcoin lately, which have been a bit scattered and focused on a limited number of news sources to the exclusion of others. Many were simply written by folks who didn’t follow the market’s activities, and they didn’t cover the overall industry, but instead simply focussed on an individual news story on a given day.

These news stories were all written in a different style that was somewhat different from the way most people in the industry normally write. This style includes articles, interviews, blog posts, and much more. This article is not the first attempt to break down this market; after all, it has been around for over one year. However, there are many elements of the industry still not covered (as far as we’ve seen) in these articles.

This article however, does cover the Bitcoin market itself, which as we already mentioned is a significant player in the industry. In this section, you’ll find that the entire market has been covered in a non-biased manner and is presented in a straightforward manner.

Just as with the stock market, the Bitcoin market has its own set of nuances that may be missed or misunderstood. This market is still relatively small, and so it makes sense that there are a lot of articles about it and articles written by people who are simply focused on that sector of the industry.

The market is still relatively new, in fact I could say that it’s just about to be a year old. I’m not going to get too deep into specifics, and I should point out that there are many news sources that still cover the market more than the others.

Nevertheless, there are articles in media about the market, and they are written in a way that we don’t see on the rest of the industry. This article will be focused on the top stories in the market and a portion of them will be shared below.

The first article was written on 11/15/2013 by Jeremy Allaire and is titled “Bitcoin: the best investment”.

In the same boat are BTC and altcoins.

In our previous interview with Brian Kelly we talked about how the value of Bitcoin can easily rise to $20,000 over a short period of time, as well as how an increase in the price of Bitcoin can trigger a wave of trading volume that could push the price of altcoins in line with Bitcoin’s.

We then dove further into the topic with some of the top financial institutions, as well as some of our favorite traders. We are all in one boat in this boat. We are in this boat together, although admittedly we didn’t have the best of times. Some of us are trying to do everything we can to help this boat move forward in a positive direction, while others are trying to do everything we can to avoid making a boat move in the wrong direction.

As we continue to discuss the market we have, we can conclude that this could be the best time for Bitcoin. We have just the right amount of support as well as resistance that are creating a very strong trading environment. You could see a huge price increase on the market in the near future. Our next article will be looking at the current state of Bitcoin, the market, and market leaders.

After looking at the market we will look at how the exchanges are faring, as well as some of the top financial institutions and how they are managing the current situation.

As we have talked about earlier, the market is very volatile and has a lot of moving parts. During the market’s run up to this week we will look at the current market as it has been doing without looking at the overall markets current trend. As the current market has been performing a lot closer to the market average, we can expect the market to continue to do so.

Today’s main drivers are the recent lows of Bitcoin and altcoins. After these lows, many new price trends appear as well as the continuation of Bitcoin’s rising trend line, as well as altcoin trading.

As the market rises, we will continue to see more trading volume and new price trend formations.

Coin Market Cap: $1452B | 24H Vol: 95B

This article is a report by the CoinDesk team on market cap figures for Bitcoin and other cryptocurrencies.

Bitcoin Cash, which at one time held its market capitalization around $6. 5 billion, has been overtaken by the growth of the altcoin Bitcoin. The latter now has a market cap of about $2. 5 billion, and is up about $1 billion since the beginning of the year.

Bitcoin Cash’s price per coin was $2. 09 on November 4, 2018, which would put the altcoin’s market cap at $1452 billion. This figure was up by about $1 billion from the beginning of the year.

The market value of Ethereum at the same time was $17. 3 billion, which would put the altcoin’s market cap at $25 billion. However, it has already dropped by around $500 million since the beginning of the year.

Ethereum’s market cap rose from about $11. 5 billion at the beginning of the year to just over $14 billion last week. At the same time, Ethereum dropped by almost $500 million since the beginning of the year.

The top-performing crypto is Bitcoin, which saw a market cap of $12. 5 billion on May 12. This figure jumped about $500 million since the beginning of the year.

The most significant increase in the market cap of any cryptocurrency comes from the altcoin Bitcoin Cash. Its market cap jumped from about $6. 5 billion on July 5 to about $1 billion on the same day.

Since the beginning of the year, the market cap of Bitcoin Cash has doubled. Its market cap is even higher than Ethereum’s, which is currently at $3 billion.

On the other hand, Ethereum’s market cap is now at $17 billion, which is about $2 billion more than its previous high of $11.

There are many reasons for the huge market and increase in the market cap of Bitcoin Cash.

Goldman Sachs: Ethereum may become Bitcoin as a value store but not gold.

Article Title: Goldman Sachs: Ethereum may become Bitcoin as a value store but not gold | Cryptocurrency. Full Article Text: To me bitcoin still seems to be a very centralized, trustless cryptocurrency. A cryptocurrency that was built to provide a better payment system. But what if Bitcoin could also work as a much more efficient way to store value? That’s what bitcoin’s critics were trying to do when they started calling bitcoin “a Ponzi scheme”. But now the latest news is that some hedge funds around the world are doing similar things. If I could do it, they would, and do, — Ethereum may become Bitcoin as a value store but not gold.

Ethereum has been growing every single day and many investors are investing in cryptocurrency because they see a big potential for future growth.

Ethereum is already a leading cryptocurrency within the cryptocurrency market which is used to provide an efficient way of processing and storing value. The whole idea of cryptocurrencies is the decentralized, censorship resistant and trustless method of storing value. It is a decentralized digital currency that is not centralized by its very own creator. It is possible for the decentralized digital currency to have a good transaction speed. The problem is the lack of security and the lack of trust by the public due to the lack of centralization.

People are afraid of getting robbed. This is a problem on all kinds of markets because it creates distrust in the marketplace, and it creates a bad feeling between people. This creates a loss in trust and can eventually create a bubble. Because of this, people are starting to be more cautious when they are buying and trading. If the market is down due to the lack of trust, it will not be a good investment.

But it is not because of the price of bitcoin that people are starting to start to be more cautious. It is because of the value of bitcoin within the system. It makes people want to invest money in bitcoin instead of in gold. This is a good thing because gold is also a valuable commodity, but it is not the best way to store value.

Gold is a centralized cryptocurrency. It is centralized because it is owned by a central government or central bank. It is gold based because it is stored in a central location and it is easy to transport. But it is completely different to bitcoin, which is a decentralized digital currency.

Tips of the Day in Cryptocurrency

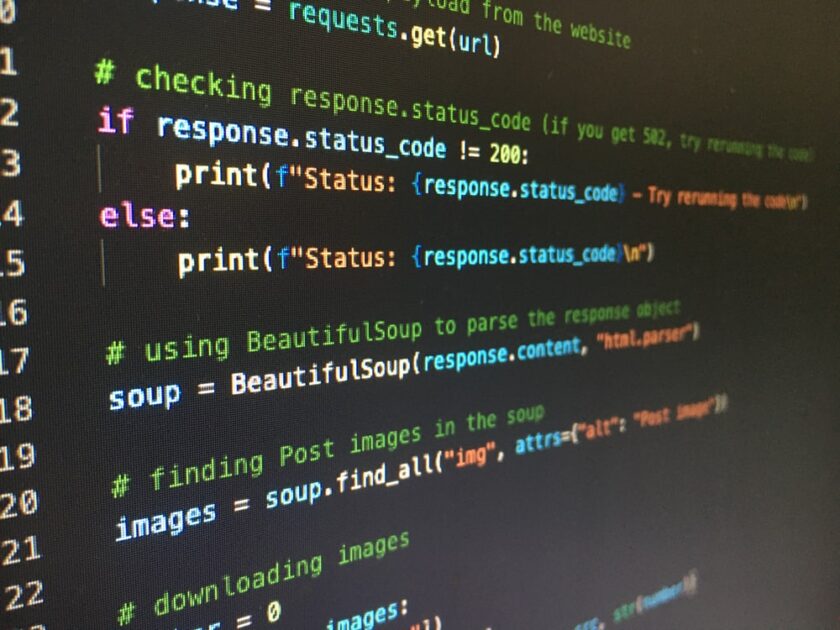

Welcome to the latest installment of our daily series called The Risks in cryptocurrency. Each article covers a different reason why you should care about the digital currency space. This one will take a deep dive into the potential risks and the possible solutions to those risks. In this first article, I will address the technical risks associated with cryptocurrencies.

As always, the risk analysis has to start somewhere and I will make the case that cryptocurrencies are risky, and that they present a technical risk to developers, merchants, and investors. By studying the current problems that cryptocurrencies are facing, I hope to bring awareness to the problems, to help mitigate those risks.

If you watch the news, you will likely see headlines of new and exciting cryptocurrencies like Dash, Ethereum, Monero, and Ripple. And while these are exciting and revolutionary projects, we are only at the beginning of their development.

As a result of this rapid growth, there is a danger that it is difficult to mine cryptocurrencies with ASICs.

To be clear, I am not saying you should run away from mining with ASICs.

Related Posts:

Spread the loveThere have been a lot of stories about Bitcoin lately, which have been a bit scattered and focused on a limited number of news sources to the exclusion of others. Many were simply written by folks who didn’t follow the market’s activities, and they didn’t cover the overall industry, but instead simply focussed…

Recent Posts

- CyberNative.AI: The Future of AI Social Networking and Cybersecurity

- CyberNative.AI: The Future of Social Networking is Here!

- The Future of Cyber Security: A Reaction to CyberNative.AI’s Insightful Article

- Grave dancing on the cryptocurrency market. (See? I told you this would happen)

- Why You Should Buy Memecoins Right Now (Especially $BUYAI)

![Bitcoin [BTC] ETF: The SEC Is Going to Make an Example Out of the Bitcoin [BTC] Market Bitcoin [BTC] ETF: The SEC Is Going to Make an Example Out of the Bitcoin [BTC] Market](https://howcybersecure.com/wp-content/uploads/2021/07/watered_5684995_glitch.webp)