Bitcoin Legal Tender in El Salvador

by Team

A new virtual currency, made of blockchain technology, called eCoin (el) is being introduced as a legal tender in El Salvador.

While the currency might appear on a blockchain as a series of data, such as a transaction, the eCoin has a different function, that is to be a means of payment for goods and services.

This virtual currency is being launched in an effort to raise the level of the economy by creating the best and the fairest economic models to be found in the world, by creating a currency to be used for the sale and the buying of goods and services.

The blockchain technology was developed by a team of scientists led by Dr. Juan Antonio López (University of Guanajuato), which is the head of the blockchain technology, the first part of the whole Blockchain project. This technology is used in the creation of this virtual currency and it can be found in the applications of this technology.

“The blockchain, used widely in the creation of digital currencies, is an advanced and efficient alternative to the fiat currencies developed and used by governments and financial institutions.

The virtual currency is being introduced as a means of payment for the sale and the buying of food, basic necessities, medicines, and other goods. The transactions are made between the buyer and the seller, who make the transactions in this virtual currency.

Some of the advantages of this virtual currency are that the exchange is based on the blockchain technology and the transactions are carried out by the blockchain technology, and so it can be done with minimum amount of resources.

The exchange in this virtual currency is an automated process.

The bill for the Bitcoin legal tender passes the congress in El Salvador

The bill for the Bitcoin legal tender, passed by Congress in El Salvador, is now sent to the executive.

The Congress of El Salvador passed the bill for the Bitcoin legal tender and the executive sent the bill to the president for the approval to be included as a new law in the National Law of the Republic, so that the law can be implemented and a new currency for the country to be created.

In El Salvador, the law that regulates the circulation of currency, the law that establishes the national government is the same as there. The only change made is that the new currency shall be accepted by all banks and financial institutions, and it shall be denominated in the country’s national currency, the pesos.

As a result, the new legal tender will be created as the Peso Bitcoin.

A new legal tender system is an innovation in the economy in any country, but it is not a matter of only El Salvador. In fact it is the next step in the evolution of the Latin American economy.

The Bitcoin (BTC) is the first digital and cryptocurrency that has been created in the world. The virtual currency is created by a network of users in the Bitcoin. com network.

The virtual currency can be seen by its name as a cross between the Internet and a stock. It is a new medium in financial markets and transactions.

Bitcoin has some advantages over other electronic currencies such as dollars, euros, yen, etc. Bitcoin is in itself not a currency but a form of payment that can be converted into other currency. Also, a lot of Bitcoins can be stored in computers in the form of a virtual currency.

The Bitcoin. com network, however, is not regulated by the United States Federal Reserve System. In fact, it is a decentralized network that operates under a complex process of consensus based on the ideas of network users.

When a network user receives bitcoins, they can either hold the money in another form of transaction or can exchange it for another form or currency, as it is not regulated by the United States Federal Reserve System.

Government has never regulated the Bitcoin. The United States government, however, has been interested in the virtual currency for the last seven years.

Bitcoin and the IMF.

‘The Interim Bank of South Africa and the IMF are preparing for bitcoin as a legitimate asset class.

Last night at the latest cryptocurrency conference, it was clear that bitcoin and the world’s largest cryptocurrency are not welcome in the land of the free and the home of the brave.

For the fourth time in a month, experts and analysts presented their analyses of bitcoin’s future. It was a clear warning, a call to arms, that bitcoin is here to stay, that it has to be accepted as a viable alternative to traditional currencies. And yet, it was clear that bitcoin has already been accepted elsewhere.

The conference, held at Johannesburg-based financial security firm, SIA Group, was attended by nearly 3,500 people and organized by SIA Security, with support from the Federal Reserve Bank of New York and the Department of Treasury. In a short period of time, the conference had grown in stature. It attracted the attention of major companies like IBM and Barclays, as well as the world’s largest banks and financial analysts. It also attracted the attention of bitcoin enthusiasts, investors and academics.

A number of panels covered topics like “bitcoin and the IMF,” as well as the latest in the global financial crisis – the “crisis of confidence in the banking system and the role of the IMF”. While some were concerned by the idea that bitcoin will be a global currency, others were concerned with the potential dangers of what bitcoin may mean for the world’s most powerful governments.

Among many opinions presented by conference speakers, one that stood out like a sore thumb was a warning that bitcoin – or even something that might be a better alternative – isn’t welcome in South Africa.

It was a provocative statement, one that had to be heard, given bitcoin’s explosive growth since its inception. The statement itself is not very remarkable. Bitcoin uses a type of block chain technology. It creates a distributed database and puts a monetary value on it.

Still, some prominent figures did raise some eyebrows by openly admitting bitcoin might be used by the IMF and by “international organizations” (such as the IMF) to move currencies.

The problem is not the dollar, it is the criminals.

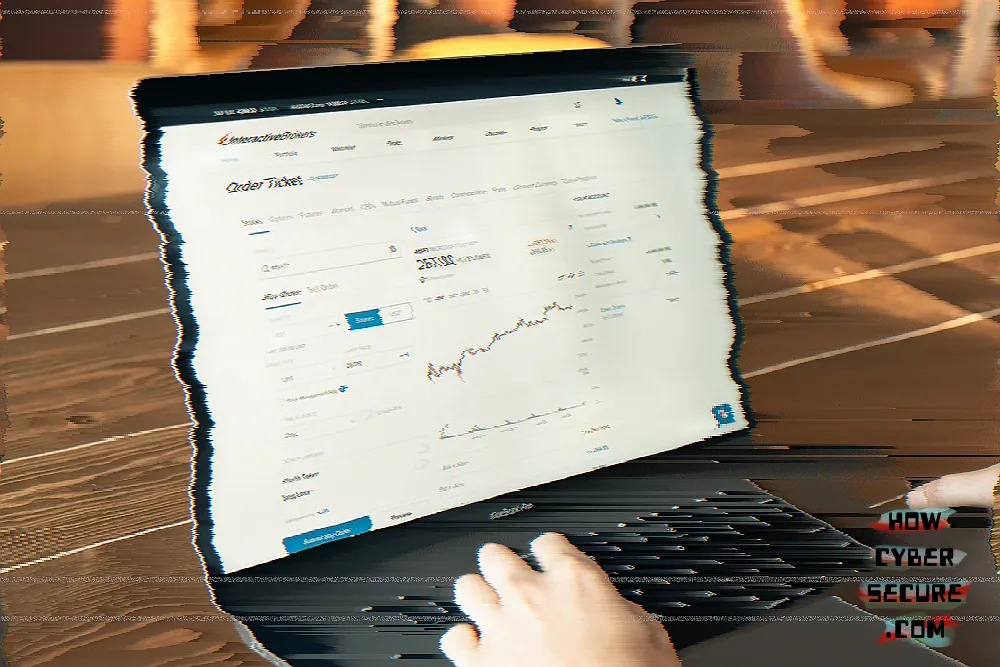

“The problem is not the dollar, it is the criminals. ” The problem isn’t the dollar, it is the criminals. – Joseph Naclerio Bitcoin (BTC) Prices are up and out of reach for the majority of people in the market. In this article, Joseph Naclerio, Chief Research Officer at Fundstrat Global Advisors, explains why this is and how to take Bitcoin price back up to its historic trend. Naclerio argues that we’re in the last few weeks of crypto markets and that Bitcoin (BTC) is finally starting to recover from the recent price downturn. Cryptocurrency markets have been a rollercoaster for decades. Yet, at the same time, the cryptocurrency markets have been on a consistent uptrend that hasn’t always been in the top 10. A look at the following chart through May 22, 2019 shows that Bitcoin has never been on a sustained uptrend during the past 5 years. The chart also shows the top 10 cryptocurrency markets, and the crypto markets, at the time that BTC has been trending higher over the last 5 years. Naclerio believes that the reason Bitcoin’s trending up again is because of traders who are buying and holding the token, and investors pulling back out of the markets. It is these investors that are ‘buying’ Bitcoin instead of ‘selling. ’ Instead of buying Bitcoin and holding it for longer, and then buying it later, Naclerio believes the best way to invest in Bitcoin is now. “The problem with investing in Bitcoin and other assets, particularly in fixed income, is that there are so many people who are buying Bitcoin. The problem is not the money, it is the people who are buying it. ” “The problem with investing in Bitcoin and other assets, particularly in fixed income, is that there are so many people who are buying Bitcoin. The problem is not the money, it is the people who are buying it. ” This article first appeared on The Crypto Investor’s Newsletter.

Tips of the Day in Cryptocurrency

Cryptocurrency prices have been on a solid upward trajectory over the past few months, with many leading cryptocurrencies gaining a lot of attention in the market.

However, one of the biggest questions is still out there: What will happen in 2019? So, let’s take a look at some predictions out of the cryptocurrency market.

Bitcoin to reach $20,000: This will be the year that BTC breaks out of what will likely be the biggest bearish trend in the market since it’s inception.

A more reasonable prediction is that Bitcoin will trade at a high of $11,000 on July 31st, 2018. This could happen if BTC sees some good momentum or support with some big price moves on a daily basis.

Bitcoin prices closed near $10,000 on January 28, 2017, where they’ve been trading since.

Related Posts:

Spread the loveA new virtual currency, made of blockchain technology, called eCoin (el) is being introduced as a legal tender in El Salvador. While the currency might appear on a blockchain as a series of data, such as a transaction, the eCoin has a different function, that is to be a means of payment for…

Recent Posts

- CyberNative.AI: The Future of AI Social Networking and Cybersecurity

- CyberNative.AI: The Future of Social Networking is Here!

- The Future of Cyber Security: A Reaction to CyberNative.AI’s Insightful Article

- Grave dancing on the cryptocurrency market. (See? I told you this would happen)

- Why You Should Buy Memecoins Right Now (Especially $BUYAI)